On the Market: Shareholder Activism

The Occupy movement garnered international attention in 2011 and 2012. The terms 99 percent and one percent became vernacular. Though the movement has since fizzled, its message still rings true today: Fortune reported earlier this year that 80 percent of the global population shares just 5.5 percent of the global wealth. What kind of impact can a middle-class professional have on the policies of Fortune 500 companies worth billions of dollars?

After the Great Depression, the US government passed the Investment Company Act of 1940, to help regulate the activities of publicly traded companies, and protect their shareholders from possible fraudulent activity. One of the powers granted to shareholders by this act was the requirement of management contracts to be submitted to shareholders for approval. These acts were standard in post Great Depression policy-making, and it is because of these policies that perhaps the most successful way for the middle class to voice their concerns to the one percent is through the stock market.

Despite one’s personal or professional feelings towards the stock market, it is difficult to question the market’s efficiency. Rob Berridge, of the Guardian, wrote back in April 2013 that the New York Stock Exchange “processes more than 28,000 trades every second.” Approximately 2 billion trades occur daily on NASDAQ. It has never been easier to get involved in the stock market as an investor.

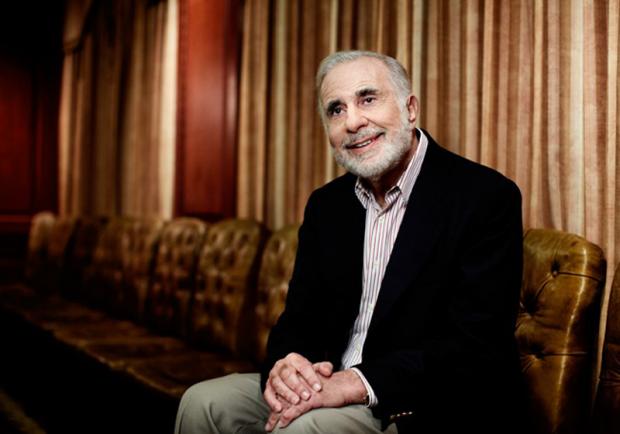

Shareholder activism is not a new practice but has harnessed a new energy from the success of individuals like Carl Icahn. Icahn took on Time Warner management in 2006 after their failed merger with AOL. His shareholder group won a number of concessions, including the replacement of the company’s board.

From the outside looking in, the chances of implementing change seem slim to none. However, purchasing stock offers an individual the ability to advocate for the change he or she wishes to see in a publicly traded organization; some are given a line of communication with top-level executives that people outside of the market could never achieve. Investors are able to use their shares to vote on management and attempt to steer the company in whatever direction they see fit. With enough support amongst the shareholders, change can occur. According to Green America, 2015 set a record for number of shareholder resolutions on “social and environmental issues,” with a total of 468 resolutions filed. Some strategies practiced by the activists include exercising their proxy vote, attending annual meetings, corresponding with management and submitting resolutions. A company’s board cannot afford to ignore the requests and resolutions of their shareholders because their jobs are possibly at stake.

Though not every resolution will lead to action, the voice of the shareholders has grown stronger: “A group of investors pressed oil and gas firms to end the wasteful burning of natural gas in North Dakota’s Bakken region, a phenomenon that not only creates greenhouse gas emissions but can also be seen from space,” Berridge wrote. Larger companies like Yahoo have had to address requests by their shareholders as well. Earlier this year the current CEO, Marissa Mayer, had to handle a situation where one of Yahoo’s largest investors demanded the company return the proceeds it earned from its pre-public purchase of Alibaba in 2005 to its shareholders in a “tax-efficient manner,” according to Business Insider.

This is not a call for individuals to start investing in the companies they dislike, but more an explanation of how there may be better strategies of reform than a typical boycott or demonstration. Some of the most successful change occurs by opening lines of communication. Shareholder activism has found some success and has the unique capability to extend across the entire socio-economic spectrum.

Any opinions are those of Ari Goldfarb and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.