On the Market: The BRIC Nations

Fresh on the heels of China’s economic boom in the early 2000s, a Goldman Sachs economist named Dominic Wilson published a report titled “Dreaming with BRICS.” The article predicted the global economy would be dominated by four emerging economies by the year 2050. It was one of the first publications indicating a shift of economic power from Western nations to the South and East. The term BRIC was coined two years earlier by another Goldman Sachs economist, Jim O’Neil, who noted in his paper, “Building Better Global Economic BRICs,” that Brazil (B), Russia (R), India (I), and China (C), were set to have over a 1.5 percent growth in their GDP. These countries were supposed to lead the world into a new, prosperous, economic age.

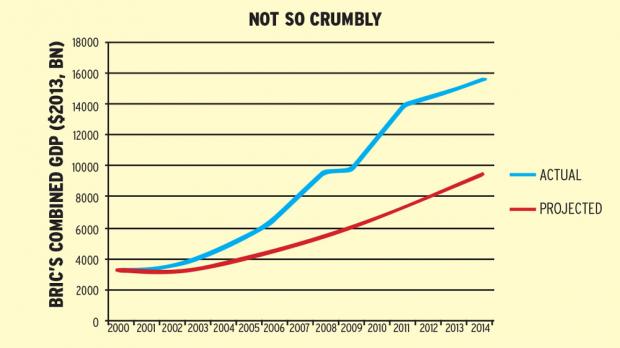

When the report was first published, the four countries’ combined GDP was worth just under 15 percent of the G6. Goldman Sachs prediction relied on an average 2.5 percent growth by the BRIC nations from 2000 to 2050. A chart published by the Economist shows the four nations outperforming the original projections for their combined GDP. The four emerging markets became leading topics of global economic discussion and speculation. Suddenly the commodity trading between Brazil and China captured the world’s attention. Brazil’s growth was more than impressive; it was not only granted the 2014 World Cup but also the 2016 Olympics in Rio.

However, as quickly as they rose to prominence, the BRIC bloc has begun to falter. These resource-rich nations may have ridden the speculation too far. In just over a decade, the emerging markets have gone stagnant and even shrunk. In 2015 Brazil’s GDP shrunk by -2.5 percent—second to last, just ahead of Venezuela. The fall of commodity prices and government corruption have landed Brazil on Bloomberg’s 2016 forecast for worst economies. To put that in perspective, after the collapse of its economy, Greece is predicted to shrink only by -1.7 percent. The Brazilian government made a bad situation worse through “unproductive tax breaks” and various other expenditures it could not afford.

Almost every member of the BRIC economic blog is struggling. On January 11, the New York Times reported that Russia’s primary stock indexes plummeted due to the continued drop in oil prices. Oil is currently selling around $30 per barrel, a number that has not been seen since before China’s boom in the early 2000s. The economy further struggles from Western sanctions put in place after its 2014 annexation of Crimea and its continued backing of rebels in the Ukraine. Russia was aware that harsh times were ahead but did not expect things to be so difficult so soon. They disregarded a rule that requires “a three-year budget cycle because of the high degree of uncertainty.” Unfortunately for Russia, the 2016 national budget was written in October 2015 when the Kremlin expected the average price of oil to be around $50 per barrel.

After years of market manipulation, the Chinese slowdown has caught up to the Shanghai exchange, causing the stock exchange to suspend all trades multiples times since the start of 2016. According to CNBC, if the market rises or falls by five percent, trades are suspended for 15 minutes; if it falls seven percent, circuit-breakers cut off trading for the rest of the day. Other problems with the Chinese economy are a rising debt from bad loans and an aging population. Its growth has become unsustainable yet leadership has attempted to continue steady progress with little substance. The results could be catastrophic.

Of the four nations, India appears to be in the best shape. With the second-largest population of any country, India has had some of the most consistent productive gains of the four nations. In fact, it has outperformed previous estimates, postng a GDP growth of 6.9 percent instead of 4.7 percent in 2014. Part of the reason is India’s growing middle class. Though only making up around five percent of the population, a report by Ernst & Young predicts the number could grow to 200 million by 2020 and more than 400 million by 2030. The declining oil prices, which have harmed the Russian and Brazilian economies, are helping India. As the fourth-leading consumer of fossil fuels, every drop in the price of oil benefits the country’s import bills; the Economic Times reports that every $10 drop in oil reduces India’s current deficit by .5 percent of GDP.

The original BRIC predictions by Goldman Sachs economists could still prove accurate by 2050. They acknowledged that even though the four countries will have fast-growing economies, their populations would still be poorer than the average G6 country. Or, the fall of commodity prices may have dug a hole too deep for three of the countries to climb out of.

Ari Goldfarb is not affiliated with Raymond James. Views expressed are the opinions of Ari Goldfarb and the Financial Advisors at Goldfarb Financial and not necessarily those of Raymond James. Goldfarb Financial is an independent firm. Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC.

Raymond James is not affiliated with and does not endorse the opinions or services of Dominic Wilson or Goldman Sachs. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize ,or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.